Lodge Your Tax Return Easily

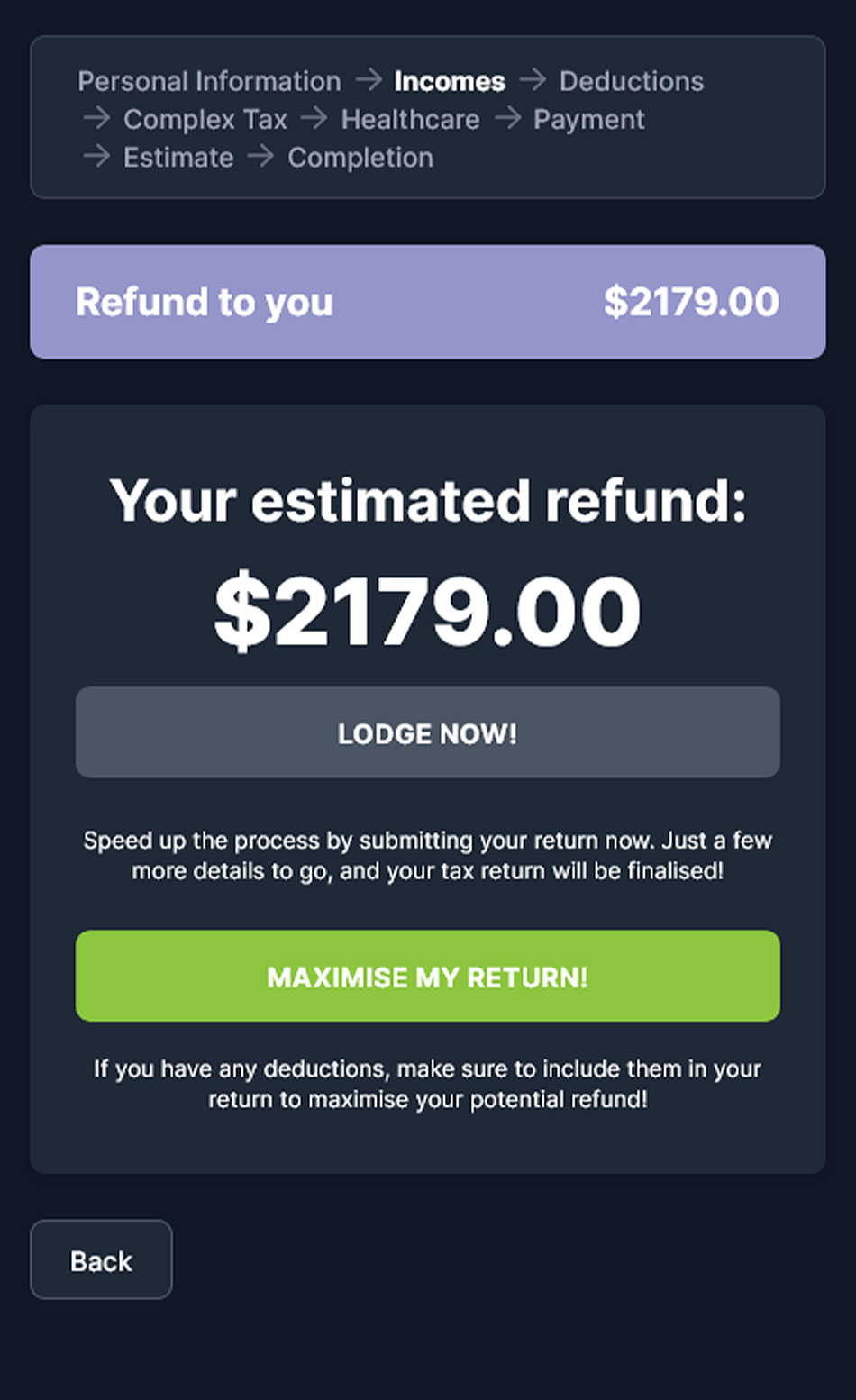

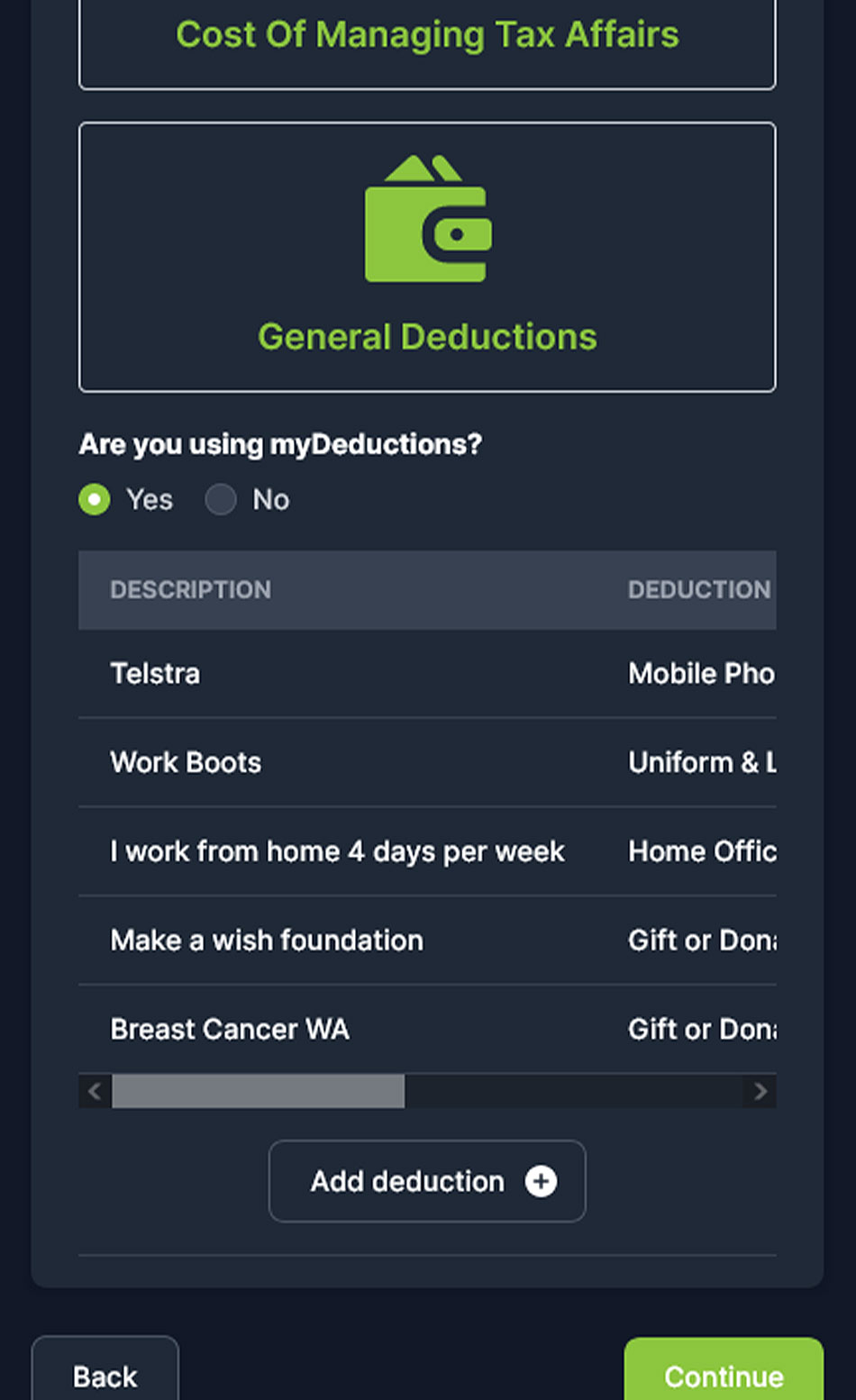

Maximise Your Tax Return

Maximising your tax return online has never been simpler with TaxReturn.com.au! Our tax app is built to ensure you claim every deduction you’re entitled to. Plus, our accountants will review your submission before it reaches the ATO, so we guarantee you will get your maximum tax refund.

Returns Checked By a Tax Agent

Rather than lodge your tax return yourself, trust our taxation experts to maximise your deductions. You’ll get the maximum refund you’re entitled to, all with a few clicks!

Lodge Your Tax in Just 10 Minutes

We’ve made tax easy for the average Australian. If you need help, our extensive customer support team are on hand to answer any questions you have.

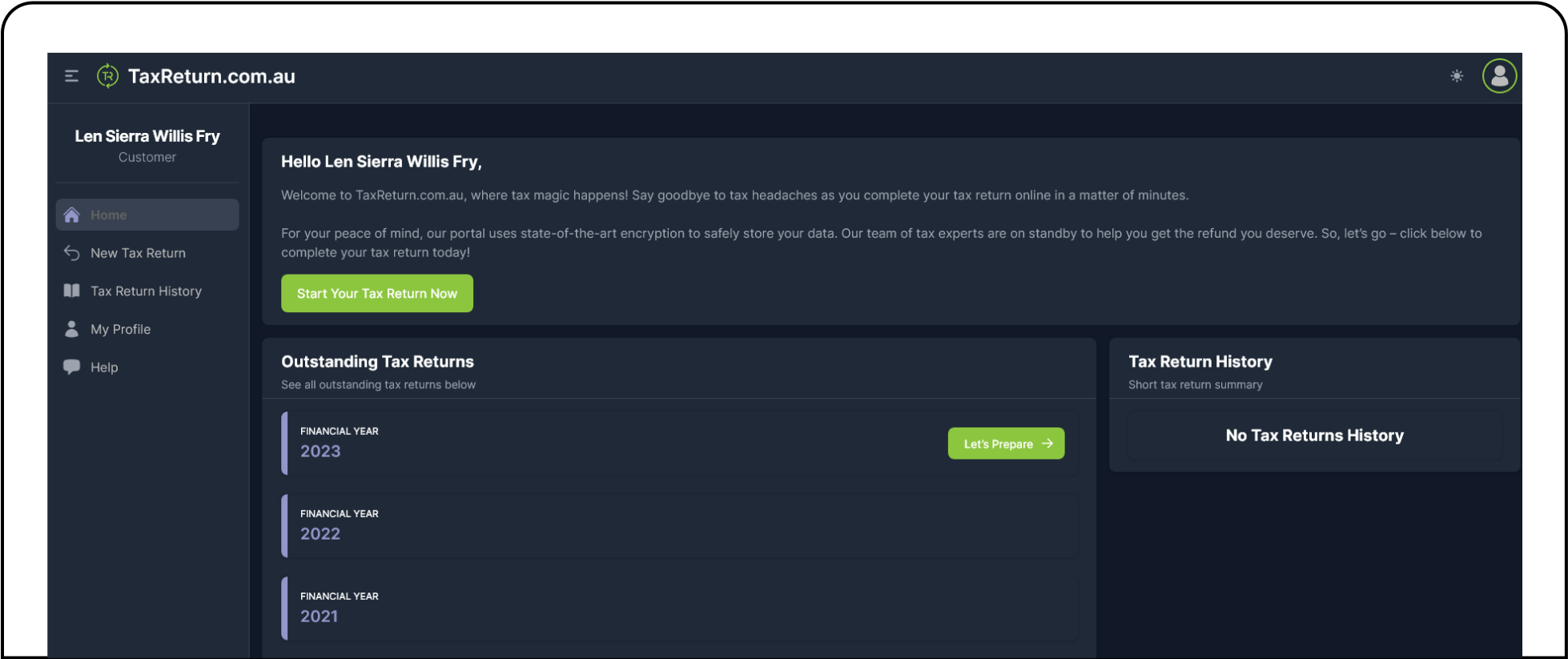

Fast, Easy to Use App

The TaxReturn.com.au platform is intuitive and user-friendly, allowing you to navigate through the process with ease. No more spending hours sifting through receipts or navigating complex forms. Our app guides you step-by-step, ensuring you don’t miss any crucial information. Whether you’re on your laptop or smartphone, you can save your progress to continue later.

Step By Step Guidance

Follow the helpful prompts to submit your tax return easily.

ATO Integration

Our portal automatically populates all your important details.

Don't Pay a Cent Upfront

At times, money can get tight and we understand that. That’s why we offer a fee-from-refund service, which means you can get your tax return sorted without having to spend a cent upfront!

Pay Later

Use our popular fee-from-refund service to pay $0 upfront.

Get Tax Done Sooner

Submit your tax return when you want, not when you have the cash.

Reviewed by Real Accountants

At TaxReturn.com.au, your tax return is reviewed by real accountants. You can rest assured knowing that your return will be lodged according to ATO requirements and that no deductions will be overlooked.

We’ll Keep You Compliant

Our taxation experts will ensure you comply with Australian tax laws.

Direct ATO Lodgement

We lodge directly to the ATO, meaning you’ll get your refund sooner.

Get Your Max Tax Back!

Your tax return will be reviewed by a qualified accountant to ensure you get the maximum refund.

Our Pricing

Standard

$79 ($0 unfront fee)

- Unlimited deductions

- Salary & wages

- Dividends & interest

- Government payments

Add-ons

- Unlimited deductions

Complex

$179

- Unlimited deductions

- Salary & wages

- Dividends & interest

- Government payments

- Personal services income or capital gain (includes up to 10 financial investments)

Add-ons

- Motor vehicle logbook $59

- Each additional capital gain (FI) $79

Rental Property

$199

- Unlimited deductions

- Salary & wages

- Dividends & interest

- Government payments

- Rental property (1 Included)

Add-ons

- Motor vehicle logbook $59

- Each additional capital gain (FI) $79

- Additional rental or business $99