[Updated 22 September, 2025]

The most recent financial year saw around 9 million Australians claim work-related expenses on their tax return, with deductions totalling about $28 billion. A large portion of these claims came from people working from home.

Many will agree there are clear advantages to remote work. There’s no need for daily commuting, office clothing, or buying lunches. But working from home also means higher electricity bills, greater reliance on the internet, and the need for reliable office equipment and furniture. The good news is you can still claim many of these costs on your tax return — provided you meet the ATO’s rules and keep accurate records.

How Do You Know What You Can and Cannot Claim?

The ATO’s guideline is pretty simple. You can claim deductions for expenses for:

- Working from home to perform your employment duties and not just taking client calls, checking emails, and other minimal tasks

- Additional costs when working from home

Now, what if you have a home-based business? If you operate your business directly from your home, there are also deductions that you can claim. You also qualify for the same deductions even if you do not run your business from your home. For example, you go to a client’s house to perform your duties as a tiler. The same rules apply when you work from home in a home office setting as long as you do all the recordkeeping in your home and you store your equipment or tools relating to your business on your property.

Home Office Expenses

If you have a home office, you can qualify for a deduction for the following expenses:

- Occupancy expenses, including rent, mortgage interest, house insurance premiums (with strict limitations and not everyone will qualify), and land taxes

- Electricity bills, including heating, cooling, and lighting

- Home office equipment, such as printers, computers, telephones, and laptops

- Phone calls and phone rental

- Home office furniture depreciation, such as cupboards and desks

- Office equipment depreciation, including computers, tablets, and mobile phones

- Other items that you use for work, such as computer consumables, stationery, corporate calendars, cleaning costs, and furniture repair

If you do not have your own separate space for working from home, it’s crucial to calculate only those expenses explicitly relating to your job. For example, the rest of your household also uses lights, heaters, and air conditioners. Therefore, you can only claim a portion of the utility bills when you actually use the appliances and lighting for work.

If you just purchased home office equipment, such as a computer, you are entitled to claim a deduction for that purchase. All depreciating assets are claimable for their full cost if you spent $300 or lower. If the item is worth more than $300, you can only claim the decline in value. Meanwhile, if you are self-employed, you may be able to claim the cost of new equipment under the instant asset write-off rules. The threshold for this deduction is not fixed — it changes frequently as part of the Federal Budget and ATO updates. That’s why it’s important to always check the current limit for the financial year you are lodging to make sure you’re claiming correctly.

How Much Can You Claim?

The total deduction that you can claim depends on what you can claim and how you work. Let’s say that your home is the primary place of work, and you have your own space for working. In this case, you can claim occupancy and running expenses, as well as business phone costs and office equipment decline in value. On the other hand, if you work at home but do not have a separate area for your employment duties, you cannot claim occupancy expenses and depreciation of carpets and light fittings. You can, however, claim a decline in the value of office equipment, including computers, desks, and chairs.

There is no maximum in the amount of deduction you can claim. The amount you want to claim must be calculated based on the guidelines set by the ATO.

There are two ways to calculate the deduction. Note that you should still show a diary or receipts to substantiate your claim. ATO introduced the shortcut method, which was only usable from 1 March 2020 to 30 June 2021. Its goal was to make it easier for people working from home to calculate their expenses. This method is similar to the fixed rate method, which is explained below. The main difference is that you could claim 80 cents per hour for every hour you work from home.

Now, let’s discuss the allowed methods for calculating deductions for work from home expenses 2021. As mentioned, you have two options:

- Fixed Rate Method

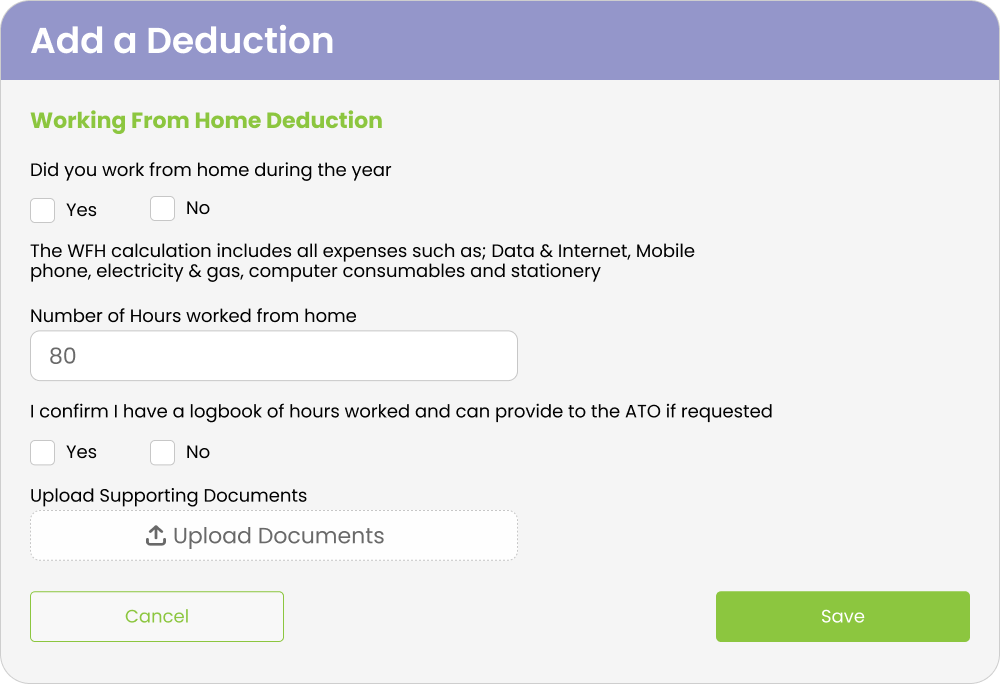

From 1 July 2024, the fixed rate is 70 cents per hour for each hour you work from home. This rate covers energy, phone, internet, stationery, and computer consumables. You can also separately claim depreciation of equipment such as desks, chairs, and laptops. A dedicated home office is not required, but you must keep a record of the actual hours you worked from home.

The ATO has provided a home office expense calculator if you have trouble determining your deduction. However, note that the result you get should be used as a guide and not an accurate figure of your total work from home deduction. - Actual Cost Method

This method requires you to calculate the actual work-related portion of your running costs, including electricity, gas, internet, phone, cleaning, and depreciation. It is more detailed and requires receipts, invoices, and reasonable apportionment, but it may result in a larger deduction if your costs are high. It’s essential to keep all receipts and other pertinent documents, so you can use them as proof for your calculation. We recommend signing up with TaxReturn.com.au if you haven’t done so to keep track of our expenses and receipts. You can simply upload them and check the information as you fill out your tax return information.

Keeping a Diary

To make claims much easier, you should have receipts and a diary that will help back up your claim. Diaries are useful in recording small expenses, such as those that are $10 or less, up to $200 in total. Some expenses do not have receipts or evidence of any kind. You can write them down as an entry in your diary, which you will show the ATO.

Diaries are also used for your running expenses, such as heating and lighting. It should provide all the details, including the time you spent in the home office compared to other members of the household or parts of the house. A diary record should at least contain four weeks of a representative period, which will include calculations based on your use of home office equipment.

The Temporary Shortcut Method (historical)

The shortcut method (80 cents per hour) was a temporary option during COVID, available from 1 March 2020 until 30 June 2022. It can no longer be used for current claims. If you see references to this method in older resources, they are historical only.

Know the Expenses You Cannot Claim

Understanding the working-from-home expenses, you are not allowed to claim is as important as knowing what you can claim. The ATO issued a warning to Aussies working from home. Lists of tax deductions will be carefully examined because so many people are claiming various deductions that they are not eligible for because they are working from home.

Five Things You Cannot Claim as Working from Home Deductions

- Occupancy Expenses – Many taxpayers wrongly believe that because you work from home, you should be able to get deductions for mortgage repayments, rent, or interest. There are limited circumstances where these can be deducted, but few people qualify.

- Time Spent Not Working – When calculating the hours you work each day, do not include your lunch break and any time you spend doing something other than work.

- The Decline in Value of Items Provided by your Employer – Many companies provide the tech equipment necessary to keep their employees working when working from home is a necessity. However, you cannot deduct depreciation of equipment you did not pay to own.

- The Niceties – Your employer may have supplied coffee, tea, sugar, cream, and biscuits at the office. However, you cannot deduct the cost of similar grocery items purchased for use in your home office.

- Items You Buy, but Your Employer Pays Reimbursement – If you are reimbursed for something you bought, you technically did not buy it.

What Are the Current Tax Rules for Claiming Work From Home Expenses?

From 1 July 2022, the fixed rate was revised from 52 cents to 67 cents per hour, and new record-keeping rules were introduced. From 1 July 2024, the rate increased again to 70 cents per hour.

Key changes include:

-

You no longer need a dedicated home office space to use the fixed rate method.

-

You must keep records of all hours worked from home (timesheets, rosters, or a diary kept across the whole year).

-

You can still separately claim depreciation of assets, such as laptops and desks, if they are used for work.

Taxes can be a challenge, even if you have lodged them many times in the past. If you are unsure what you need to do, feel free to reach out to us at Tax Return. Our tax portal and tax experts can help you file your taxes the right way easily in minutes.