[Updated April 19, 2023]

If you have made donations to charity this year, you may be among those that can claim a tax offset for the cost of the gifts. The benefit goes both ways: other people get the financial assistance you offered, and you get to save money during tax time.

Before you begin to claim, you should understand a few things first. This blog post will help you with the rules and regulations that govern tax-deductible donations.

Is Your Donation Tax-Deductible?

Many Australians have a cause that’s close to their hearts. You may be among them, which is why you want to know if your charitable donations are qualified for a tax offset. The hint lies in the organisation you picked.

Quite a number of organisations are considered “deductible gift recipients” or DGRs. If the organisation you chose to donate money to has the DGR status, you can claim a tax deduction.

How Much Tax Can I Claim on Donations in Australia?

As per ATO, donations to deductible gift recipients in Australia qualify for tax claims. That includes qualifying charitable organizations and political parties. Your tax claim would depend on the type of gift donation you give. For bucket donations, you can claim up to $10 without a receipt. Any amount above that would require a receipt. For political donations, you can claim up to $1,500 for donations made to political parties or independent candidates.

How Does It Work?

A deductible gift recipient (DGR) is a fund, registered group, or organisation that the law allows receiving tax-deductible donations or gifts. Running a charity does not automatically mean it is a DGR. You can look up the organisation to see if it has a DGR status via the Australian Business Register website or Australian Charities and Not-for-Profits Commission (ACNC).

If you did donate to a DGR-endorsed organisation, there are still other requirements to fulfil, which are the following:

- You gave an actual gift, which means that you will not receive any form of tangible benefit out of it. Let us say that you participated in a charity auction where you purchased a piece of art. It is not tax-deductible because the item is considered a material benefit. An example of a tax-deductible donation is if you donated money to a charity and you did not receive the piece in return.

- If you gave a monetary donation, it should be more than $2.

- If you donated property, it should have been purchased in the last 12 months (at least). This condition also applies to shares.

- You can trade stocks but should be outside your normal business operations.

- You made the transfer voluntarily.

You are always welcome to give anything you deem valuable for the charity. However, if you plan to seek tax deductions, the gift should meet the requirements above.

The following may be considered gifts, but are not tax-deductible:

- Raffle tickets and others that were purchased from a charity or to support a cause

- Buying low-cost items, such as pens and chocolates

- Paying to become a member of an organisation

- Paying a school building fund rather than increasing the school fees

- Offering a service – even as a volunteer

- Gifts covered by a will

- Donating gift vouchers to a charity or DGR

Anything that you give to an entity where you gain a benefit in return is not considered a gift. However, tax offsets may be applied in such an instance if it is regarded as a contribution.

Contribution vs Gift

Compared to a gift, you can get something in return when you make a contribution. It is also tax-deductible. For instance, you purchased a ticket to participate in or support a fundraising dinner. Contributions are only tax-deductible if they are provided to a DGR. The fundraising event should also meet the eligibility requirements, which include:

- The non-profit organisation must be a DGR

- Monetary donations made are over $150

- Property should be purchased within the last 12 months before making the contribution and should be more than $150 in value.

- Contributions can also be in the form of shares (in a listed public company) which should be acquired at least 12 months before the fundraising. The value should be at least $150 to $5,000.

If you give a gift or contribution other than money, you should provide its value to the organisation to get a tax deduction.

Taxpayers could claim a deduction if they made a contribution. With gifts, you can be any type of taxpayer, such as a company or a trust.

How to Claim Tax-Deductible Donations

The ATO lists three categories of the items that you can claim:

- Money donations that are at least $2

- Properties that meet any of the following conditions:

- Properties bought 12 months before the donation

- Properties the ATO recognises to have a value of more than $5,000

- $5,000 (or less) worth of shares

- Trading stocks

- Heritage and cultural gifts

Token items may not affect your tax deduction. Therefore, you can still make a claim even if you receive an item from the charity. It should, however, have no material value. Some examples include stickers and wristbands, which are used to promote the organisation.

But how much should you give to a charity? According to a 2019 report, Australians are quite generous. The report claimed that five out of six Aussies donate to charitable organisations. Most people pick children’s charities, animal or wildlife support. Others choose disaster relief, mental health, and medical studies.

It is not easy to know the exact amount of donations people make, including all the change in the charity tins. A 2018 report, however, showed that the tax-deductible donations claims are usually around $633.72 on average.

Another question here is, which charity should you pick? If you give $5 to help homeless puppies, are you sure it will go to the frontline services? Unfortunately, there is no enforced rule on the donation received. As the donor, you may not know how much of the monetary gift goes to the actual service and the administration. The ACNC has almost 60,000 registered charities in the country, and their details are all available to the public.

Always make sure it is a legitimate charity before donating. Use the ScamWatch website to find out if the organisation is fake.

Now, the next part is for you to boost your tax return when you donate to charity. Here are the steps:

- Keep the receipts.Once you are sure that the foundation, charity, or NFP is registered, you should get a receipt and keep it in a safe place. The receipt is often required when you hire an accountant or tax agent – or you do your own tax and lodge with the ATO.The Australian Taxation Office recommends that taxpayers should keep their receipts for five years. Even if you have already completed your tax return, you should have records to substantiate your claim. Some organisations, such as GoFundMe, do not guarantee tax offsets but they do have registered charities. These charities automatically provide the donor with tax receipts.

- Have your own record of your gifts and contributions.Be sure to include any contributions you have made for the financial year. You may be able to claim a portion of the contribution in your tax return.

- Talk to a tax agent.

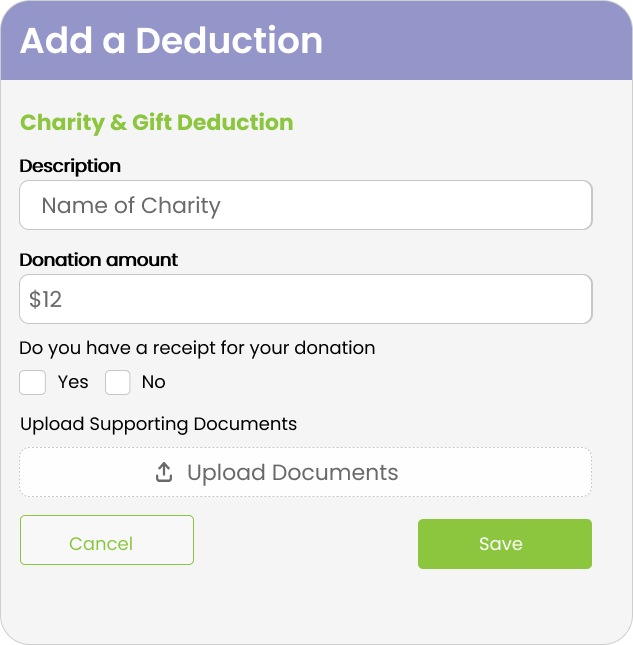

Most taxpayers are unsure of the amount and what they can claim as a tax deduction. Use TaxReturn.com.au to lodge your tax return. You do not need to sift through your expenses, income, and donations. We make it easy for you to prepare your tax return. Make sure that you provide receipts when you enter information in the D9 Gifts or donation.

Talk to our tax specialists to help you lodge your tax return and get the most out of your tax-deductible donations. Additionally, our tax portal makes adding charity deductions easy to help you when preparing your return.