[Updated 29 July 2025]

No matter how diligent and responsible a taxpayer you are, you never want to overpay your taxes. But it happens to millions of Australians, and it could also be happening to you. When tax time is just around the corner, it always pays to know your stuff – quite literally.

This blog post will help you make sure you are claiming everything you are entitled to. We will shine the spotlight on potential tax deductions that Aussies often forget to claim. Before you start, please be aware that not all claims apply to your situation. Some claimable items depend on your job or the type of work you do, as well as other factors.

So, without further ado, here are the tax deduction claims you may have overlooked:

Home Office Expenses

Whether you work from home full-time or just now and then, there are some deductions you might be able to claim. The ATO has updated the rules recently, so it’s worth checking you’re on the right track.

Working from home regularly?

If you work from home most days, you may be able to claim running costs such as:

-

Electricity for lighting, heating or cooling your workspace

-

Internet and phone usage

-

Office furniture and equipment

-

Stationery and other supplies

There are two ways to calculate your claim:

-

Fixed rate method: For the 2024–25 tax year, you can claim 70 cents per hour for every hour worked from home. This covers things like power, internet, phone, and basic supplies. Larger items, like a desk or laptop, can be claimed separately.

-

Actual cost method: This involves working out the exact work-related portion of each expense. It takes more time but can be worth it if your costs are high.

You’ll need to keep records of your actual hours worked from home, not just an estimate.

Working from home occasionally?

Even if you only work from home sometimes — such as checking emails after hours or working weekends — you may still be able to claim a portion of:

-

Phone and internet bills

-

Electricity used while working

-

Equipment you’ve paid for yourself

Just make sure you keep a log of the hours worked and any receipts for your purchases.

What you can’t claim

There are some home expenses you can’t claim, even if you work from home:

-

Rent or mortgage repayments (unless your home is your main place of business, which is rare)

-

Tea, coffee, or toilet paper — personal items don’t count

-

Double-claiming phone or internet if you’re already using the 70c fixed rate, which covers those

Stick to the costs that directly relate to earning your income, and make sure you have records to back it up.

Mobile Phone and Internet Use

If you use your phone or home internet for work, you may be able to claim part of the cost. But it’s important to know how to calculate the work-related portion correctly.

Mobile phone use

You can claim a deduction for using your mobile phone for work, such as:

-

Making or receiving work calls

-

Sending work-related texts

-

Using data for emails, meetings or business apps

If your phone is also used for personal reasons, you’ll need to work out the percentage used for work. For example, if about 40% of your usage is work-related, you can claim 40% of your phone bill.

Internet use

The same rule applies to your home internet. If you use it for work emails, video calls or accessing business systems, you can claim a portion of your internet costs. Just make sure you have a reasonable way to calculate the work-related share.

What records do you need?

If you’re claiming more than $50, the ATO requires evidence such as:

-

A four-week diary showing how much is for work

-

Phone or internet bills

-

Notes or screenshots showing usage patterns

Keeping records makes sure your claim is accurate and helps avoid any issues if the ATO reviews your return.

Using the fixed rate for working from home?

If you’re already claiming the 70 cents per hour fixed rate, that rate includes phone and internet use — so you can’t claim them separately. To claim these expenses individually, you’d need to use the actual cost method instead.

Car Expenses

You can claim car expenses if you use your car as part of your job — but not for regular trips between home and your usual workplace.

The ATO allows deductions for car travel that directly relates to earning your income. This includes:

-

Driving between two separate work sites

-

Travelling from your office to meet a client

-

Picking up supplies or equipment

-

Visiting a temporary job location

For example, if you’re a hairdresser driving between different salons during the day, that travel is claimable. But your regular commute from home to work isn’t.

How to claim

There are two ways to claim car expenses:

-

Cents per kilometre method — For 2024–25, the ATO allows 88 cents per kilometre, up to 5,000 km per year. You don’t need receipts, but you should keep a record of your work-related trips.

-

Logbook method — Claim a percentage of all your car costs (fuel, servicing, rego, insurance, depreciation). You’ll need to keep a 12-week logbook and hang on to all receipts.

Choose the method that gives you the best result, and make sure you don’t claim both.

Self-Education Expenses

If you’ve taken a course to improve your skills in your current job, you may be able to claim a deduction. But this only applies if the study is directly related to your current work — not if it’s to help you move into a new career.

What you can claim

-

Textbooks and work-related journals

-

Online course fees

-

Stationery and supplies

-

Student services and union fees

-

Internet, phone, and travel costs related to the course

For example, if you’re a carer taking a short course to better support people with dementia, that’s likely claimable. But if you’re studying nursing to change roles, that course won’t qualify — even if it’s in the same industry.

Good to know

-

The course must relate to your current job, not future career plans

-

You must have paid the costs yourself

-

The old rule excluding the first $250 no longer applies — it was scrapped in July 2022

Keep receipts, enrolment confirmations and course outlines to support your claim.

Union Fees

If you pay membership fees or are part of a union, you may claim a tax deduction. However, the membership body must be related to your job. If you believe that you are entitled to this type of deduction, include it under D5, which is the category for “Other Work-Related Expenses.”

Donations

Donations of $2 or more to a registered charity may be tax-deductible — but only if:

-

The charity is a Deductible Gift Recipient (DGR)

-

You didn’t receive anything in return (like a raffle ticket or gift)

-

You have a valid receipt

For example, donating $50 to a DGR charity without getting anything in return is claimable. But buying a $50 ticket to a fundraiser dinner isn’t.

To learn more, check out our guide to tax-deductible donations.

Tax Affairs

If you pay for help with your tax return, the cost may be tax-deductible.

According to ABC News, around 63% of Australians use a registered tax agent to lodge their return. But many forget that the fees they pay can actually be claimed back the following year.

You can claim deductions for:

-

Tax agent or accountant fees

-

Travel costs to visit your agent

-

Tax-related reference books or materials

-

Tax software (if used to complete your return)

-

Seminars or courses about managing your tax

These expenses fall under D10 – Cost of Managing Tax Affairs. Make sure you keep receipts and claim only the portion that relates to your tax.

Work Equipment and Tools

If you’ve bought items to help you do your job, you may be able to claim them as a deduction. This applies to all kinds of roles — from trades and healthcare to admin and education.

What you can claim

-

Tools and equipment used for your job

-

Laptops, tablets, keyboards or monitors

-

Safety gear like boots, gloves, or protective glasses

-

Bags, calculators, or other job-related items

How it works

-

If the item costs $300 or less, you can usually claim the full amount in the year you bought it

-

If it costs more than $300, you’ll need to claim the cost over time (called depreciation)

-

If you use the item for both work and personal use, only claim the work-related portion

Always keep your receipts and a note of how you calculated your work use.

Record Keeping: Don’t Lose Your Deduction

The ATO won’t accept a claim if you can’t show how you worked it out. Even if you’re confident you’re eligible, you need records to prove it.

What you should keep:

-

Receipts or invoices for anything you’re claiming

-

Logbooks or diaries for car and home office claims

-

Phone bills or data logs to show work-related use

-

Timesheets or calendar entries if you’re working from home

The ATO recommends keeping records for at least five years. You don’t need a fancy system — even a simple folder or notes on your phone will help if you ever get asked to show proof.

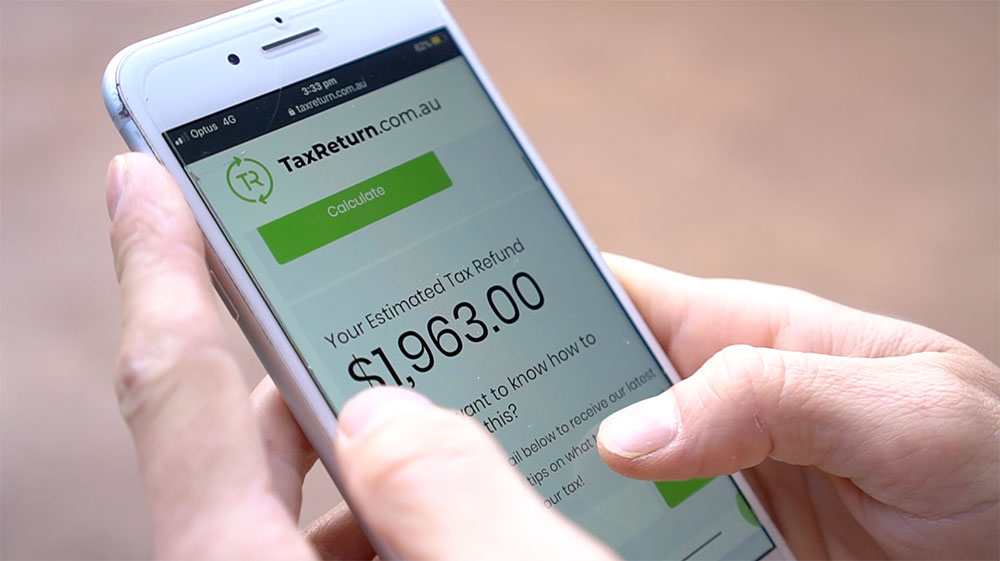

When you look at these claims individually, the sum that you can claim may seem insignificant. However, add them all together, and you can get a handsome amount of money. Remember that TaxReturn.com.au can help you at tax time. Reach out to us by phone or email, so you never overlook relevant claims again.