[Updated June 08, 2023]

How will knowing this information help you? It is simple. You can make smart decisions that will let you plan out your finances, including your business expenses. It can also help in reducing your taxable income while increasing your refund.

One important thing to note about your tax claims is that you will only be eligible for the amount you claim. Therefore, if you calculated an insufficient amount, you cannot get the full refund you are entitled to. It is why it helps to work with tax agents. These pros know the ins and outs of the Australian tax system, so they can help you get the correct amount that you are eligible to claim.

Work-Related Expenses Tax Deductions Guide

- What are Work-Related Tax Claims?

- How Much Can You Claim?

- How to Know What You Can Claim for a Tax Deduction

- Work-Related Deductions You Can Claim

- Non-Deductible Work Expenses

What are Work-Related Tax Claims?

The expenses you incur due to your occupation are work-related tax deductions. The Australian Tax Office (ATO) has strict rules and definition of such deductions. This organisation will make sure that your claim is legitimate before you can get a refund.

How Much Can You Claim?

The good news with work-related deductions is that there is no limit on the amount that you can claim. Typically, Australian workers can claim up to $300 worth of tax deductions, but this amount is mainly for those claims without receipts. If you have a receipt, you can be eligible for higher deductions.

When you have receipts, you can claim as many deductions as possible. Therefore, it is always a good idea to store the receipts in a safe place. Then, you can use them as proof of your eligibility when required.

How to Know What You Can Claim for a Tax Deduction

The ATO has certain requirements that you need to fulfil to get a tax deduction related to your occupation. To claim the deduction, you should meet those requirements first. Here are the conditions that you need to bear in mind for your tax return claim:

Conditions You Need to Bear in Mind for Work-Related Deductions:

- Same Year – When you lodge a claim, the purchase or the expense you made should be in the same tax year as the time you are asking for a refund. It means that you cannot claim a tax deduction from 2016 if you lodge today.

- Work-Related – It is called a work-related tax deduction for a reason. Your claim should be directly related to your current occupation. It includes all expenses and purchases, which should have a link to your employment.

- Proof of Use – Some purchases may serve multiple purposes, serving you at home and work. For the claim to be honoured, you will need to prove that a portion of the purchase or expense was used for your work.

- Self-Paid – You will only be eligible for reimbursement if your employer did not pay you back for the expense. If you paid for a certain item out of your pocket, but your employer already refunded you for it, you cannot claim for it.

- Proof of Purchase –You should have receipts, especially if you want to be reimbursed for a purchase that is more than $300. A logbook is also considered proof of purchase.

With those requirements in mind, you can already discern which items are tax-deductible.

Work-Related Deductions You Can Claim

- Paying a tax agent, including other expenses such as travelling to and from the agent’s office

- Taking up educational courses that are related to your field

- Acquiring formal education that a professional association has provided

- Attending a seminar for work

- Attending a workshop or a conference related to your employment

- Buying magazines, books, and journals that are useful for your job

- Purchasing tools and equipment that will aid in performing better at work

- Paying union fees

- Buying meals while at work, specifically for overtime

- Spending on your home office

- Buying software and computers for your employment

- Getting premiums for insurance for income protection

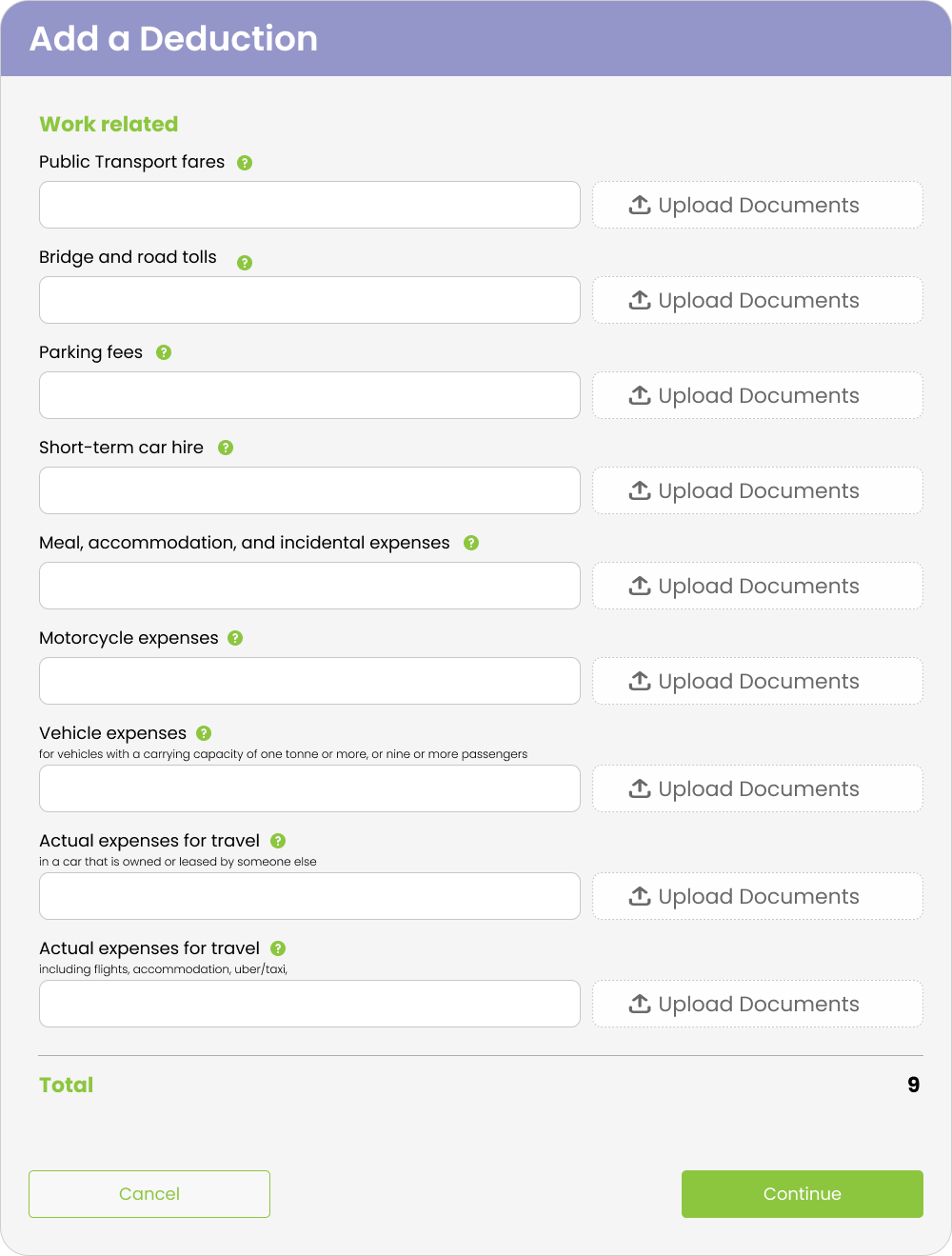

Using our TaxReturn.com.au tax portal, we streamline the process to help you make these claims easily.

There are indeed several things that you can claim if you know about them. On the other hand, it also makes sense to know the items that are not claimable as a deduction from your taxes. A common mistake is that some workers wrongly assume that certain expenses are work-related even though they are not. The ATO has decided that the following items are not tax-deductible:

Non-Deductible Work Expenses

- Driver’s Licence – If you are a company driver or you drive from home to work, you may think that you must apply for a driver’s licence. However, the costs of your application are not tax-deductible. It is considered a personal expense.

- Vaccinations –If you have contracted a disease while at work and need vaccinations for it, this expense is not covered as well.

- Child Care – Such expenses are not deductible as work-related. However, you may be eligible for a childcare benefit or rebate.

- Commuting Costs – If you have to ride to and from your work, these expenses are not tax-deductible either.

- Relocation – You cannot file a claim to get a refund if you have moved to another place, including relocating for work.

- Grooming – Your expenses on makeup, hair, and clothing are not tax-deductible as well.

Aside from the ones mentioned, you cannot write off the fines and penalties you have to pay. For instance, ATO imposed a fine in the previous or even the current year due to the late payment of taxes. You cannot claim a tax deduction if you have paid for the penalty.

Another important thing to remember is that your political contributions are not tax-deductible as well. If you have funded any political campaign, roadshow, or any setup, you cannot have these expenses written off your tax records.

Business owners have a few essential notes to bear in mind when it comes to tax claims. For instance, business memberships, which may seem tax-deductible because they are work-related. However, you cannot get a refund for them if you make a claim. Examples include being a member of a fitness, country, or travel club.

You are always free to join various communities to build your social and corporate networks that will benefit your business. However, the ATO will not let you write these expenses off in your income tax return.

Other expenses that you cannot write off if you are a business owner are:

- Outfits that you wear during meetings and other corporate gatherings unless it is your work uniform

- Sole proprietorship expenses, particularly if you are paid on a salary basis

- Expenses that you need to pay for another source of income other than your main business

Capital expenses can be quite difficult to understand. They are eligible for a reduction, but not the entire amount. Capital is typically huge in figures, which is why it may be tricky to determine how much you can claim.

A capital expense is viewed as a purchase that comprises of a long-term asset, such as a piece of equipment or machinery, or a company vehicle. You may require the help of a tax agent to comprehend how it works.

Knowing what you can and cannot claim as tax deductions can help you with tax planning. It is not easy but it can certainly lend a hand in making sure your taxes are calculated accurately.

At TaxReturn.com.au, we can help you achieve the maximum return on your tax refund. Get in touch today and get your tax lodged.