[Updated June 14, 2023]

The financial year may have already reached its end on 30 June, and the new year has just begun. It’s the best time to know how you can minimise how much goes to your taxes. We will talk about six ways to slash your taxes.

How You Can Reduce Your Taxes

- Make a Contribution to Your Super

- Maintain Accurate Financial Records

- Claim All Your Deductions

- Be More Charitable

- Pay Off Your Mortgage but Keep an Eye on Your Investments

- Know Which Income Amounts are Non-Taxable

- Learn about Salary Sacrificing and Take Advantage of It

- Pay Off Some Expenses in Advance

- Maximise Your Contribution to Your Retirement Accounts

- Take Out Private Health Insurance

1. Make a Contribution to Your Super

This first method is perhaps the easiest and quickest way to pay less tax. It entails salary sacrificing or salary packaging where you put some of your pre-tax income into your superannuation. The key step here is to make sure that you have already done so before you are taxed. So, the idea is to forgo a portion of your pre-tax salary before receiving it.

Salary sacrifice means that you’re swapping your income tax rate with your superannuation contributions tax. The latter is lower and usually 15% for most people. Therefore, if you expect that you will get an end-of-financial-year extra salary, you may want to put that money into your super instead. Make sure that you set the salary sacrifice with your employer before the confirmation of your bonus entitlement. This detail is vital because salary sacrificing is only applicable to the future and not your past income.

2. Maintain Accurate Financial Records

You’ve heard it time and again from the ATO and here at TaxReturn.com.au. It’s essential to have all your tax records in a safe place. That way, you can easily access them when they’re needed, specifically when claiming deductions. This method may seem so simple but don’t skip it. The ATO has become more inquisitive than ever when it comes to tax deductions. The last thing you want is to lodge a claim and end up with no proof that you deserve the deduction. Keeping a record of your financial documents does not have to be complicated. Just spend about 10 minutes every week logging your expenses, downloading statements, and having your receipts in one folder.

Here at TaxReturn.com.au, you can add pertinent documents by uploading them, leaving your tax return, and coming back at a later time. It’s that easy!

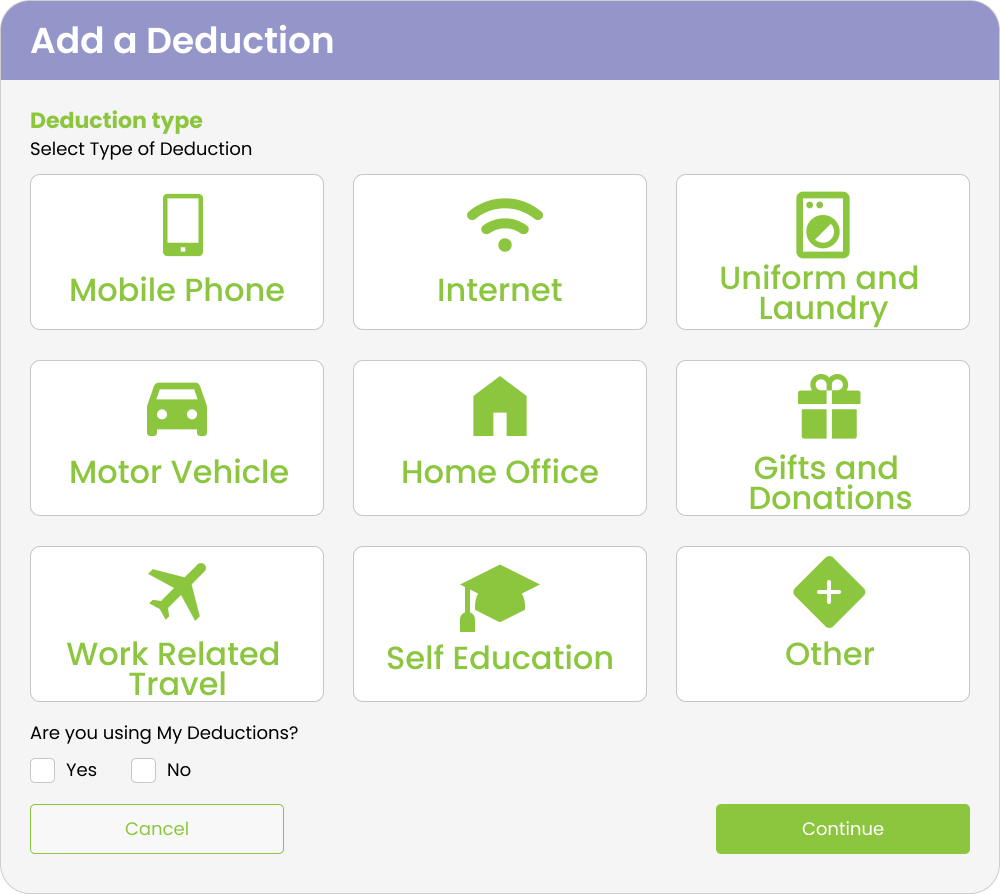

3. Claim All Your Deductions

Thousands of Australians don’t claim their deductions, missing out on the opportunity to save each year. That means the ATO gets millions and millions of dollars, which the citizens could get in their tax refunds. One reason for this is that they don’t keep financial records. They also think that their expenses are pretty insignificant, which are acceptable to lose as deductions. But the reality is that those small amounts can add up and become huge savings once you get to the end of the financial year. So, if you spend money on anything relating to your job and how you earn your income, you should claim all the deductions you’re entitled to.

The first step here is to ensure that you have declared all deductions, which is crucial to pay less tax in Australia. Don’t worry if you’re unsure whether or not the item you spent money on can be claimed. Remember that you can claim it as long as it’s work-related and you have the receipt of the purchase, which makes claiming so much easier. We also have guides that tell you what you can and cannot claim based on your profession or industry.

4. Be More Charitable

If you’re feeling charitable, follow your instinct. You’re not only helping organisations in making the world a better place, but you’re also saving some money during tax time. Every donation you make is tax-deductible, as long as they meet the following conditions:

- You have donated to a registered charity

- You have given more than two dollars

- You got the receipt from the organisation so you can file it away for the next tax season

During tax time, don’t forget to add the charitable receipts that you have and enter them into the “charity donations” section, which you can find in your tax return.

Before you get excited about tax refunds from your donations, you should note that contributions will not come back to you as a tax refund. What happens is that the gifts you have given to charities will be given back in the form of a deduction from your taxable income. Nevertheless, it’s getting a cashback from your good deed. It’s a win-win.

5. Pay Off Your Mortgage but Keep an Eye on Your Investments

Did you know that you can minimise your taxes using your mortgage offset account? It works if you have a home loan. With your mortgage offset account, you can offset your home loan’s non-deductible interest by taking advantage of the interest on the taxable earnings in a deposit. This arrangement permits Australian taxpayers to have a savings account with the lender. The difference is that you don’t need to pay the interest on the loan’s total amount. Instead, you will pay for the loan interest and get deductions through the money in your savings account.

Paying down your mortgage is excellent, and you get the bonus of not getting taxed on the money you just spent. This overpayment is even accessible through the redraw facility of your account. It’s helpful in case you require extra funds in the future.

Meanwhile, if you bought a property or have any investment, it can affect your taxes, either positively or negatively. Be sure that you understand the benefits and possible repercussions when investing your money. You should always talk to a financial planner, even if you believe you’re a skilled investor. Your investment should let you generate income now and in the coming years. You do not want to invest or not invest just to save a small amount of money from your taxes.

6. Know Which Income Amounts are Non-Taxable

The ATO has declared that some types of income are exempted, which means that they are not taxable. You want to make sure that those income types are not included in your tax return. Unfortunately, if you make this mistake, the agency will consider the non-taxable income when calculating tax losses from the earlier income years. You must deduct the non-taxable payments and adjust the taxable income of your dependents. Some examples of non-taxable gains include:

- Australian Government pensions like Centrelink’s disability support pensions for people who are younger than the pension age

- Payments and allowances from the Government, including childcare subsidy

- Payments for the Federal Police or Australian Defence Force

- Specific awards, grants, and scholarships

- Education payments from the Government like allowances for students who are 16 years old and younger

7. Learn about Salary Sacrificing and Take Advantage of It

Salary sacrificing can help lower your taxes by letting you divert a portion of your salary (before taxes) into specific contributions or benefits. You have a few options here, including making superannuation contributions, as mentioned above.

That’s not all; you should look into employer-provided benefits, which may include car leases or laptops. Some employers even offer additional super contributions. When you opt for salary sacrifice benefits, it is possible for you to reduce your total tax obligations.

Be aware, though, that salary sacrificing is not for everyone. If you have a less-than-ideal financial situation, look into other means of lowering taxes in this list.

8. Pay Off Some Expenses in Advance

Pre-paying for certain expenses can help reduce your taxable income. Not only that, when done right, it can also maximise the deductions you can claim, giving you more bonus during tax time.

There are a few important rules to follow in order for you to lower your taxes when paying in advance. First, the benefit is only applicable if your pre-paid expenses are less than $1,000 in total.

Next, you have to time the payment where the 12-month rule generally applies. That means you must make the payment before the end of the current tax year to claim the deduction. With this rule, you can claim an immediate deduction, which will be viewed as a pre-paid expense. However, you should make sure the service does not exceed 12 months.

9. Maximise Your Contribution to Your Retirement Accounts

If you are a high-income earner, this method is one of the best ways for you to minimise your taxes. The trick is to max out your retirement account. Alternatively, you can contribute a portion of your salary or bonus, which you can easily claim as a tax deduction.

The good news about this tactic is that you can max out your retirement fund no matter your income level. Look into concessional contributions, which apply to employment and personal contributions to the superannuation fund. They are taxed at a much lower rate, generally 15% less than regular income. This makes this strategy useful for those who want to reduce their tax liabilities.

10. Take Out Private Health Insurance

If you have been avoiding private health insurance, here’s the chance for you to consider it. Without such insurance, you are paying more Medicare levy surcharge. Now is an excellent time to check if you give an extra 2% Medicare levy, which, unfortunately, is mandatory for most taxpayers.

Another thing to consider is that this Medicare levy increases to 3% (or higher) depending on your income. There is a 1% surcharge on top of the 2% Medicare levy for singles without private health insurance earning more than $90,000. If you’re married and make over $180,000, you will also pay a 1% surcharge or more.

Save yourself from the Medicare Levy Surcharge (MLS), gain the benefits of being insured, and reduce your taxes effectively.

The Australian tax system can be confusing, even for those who have been doing their taxes for years. That’s why you need expert advice and assistance. Let TaxReturn.com.au help you in lodging your tax return. We’re here to guide you so you can claim all your deductions and get your refund. Contact us for more information and start paying less tax today.